Summary

- House price inflation down -1.1%, compared to +7.2% a year ago

- New house sales agreed up 17% year-on-year

- House price falls levelled out as sales improve

- Mortgage regulations a key element to support modest price falls in 2023

- First-time buyers are largest group of would-be movers in next 2 years (40%) followed by people up-sizing (34%)

- Almost half of buyers living in southern England (24% of total buyers) looking to move to find better value for money

- Property prices to fall around 2% during 2024

- On track of 1m completed sales in 2024

- 8.8% average mortgage stress test for new borrowers

- Still 10%+ overvalued market

Q4 2023 sales performed well, including prices falling

The final weeks of 2023 recorded 17% higher sales than a year ago, also ahead of 2019 levels. Due to rising incomes and lower mortgage rates, along with an increase in supply boosting choice and supporting sales. It’s clear that buyers and sellers are more aligned on pricing now, which has reduced the downward pressure on values. As of December 2023 the price decline was -1.1%, which is down from +7.2% a year ago.

Why didn’t house prices fall by more in 2023?

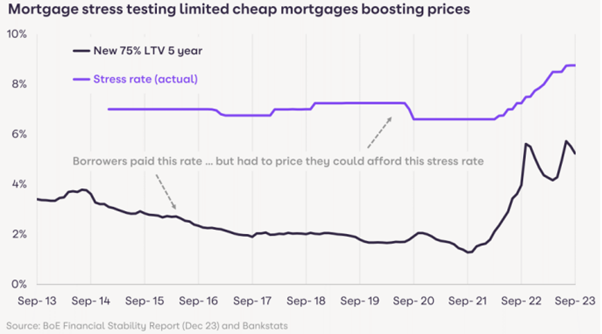

The strength of the labour market has been an important factor along with high earnings growth. Lenders have also pursued support to households struggling with repayments, which has limited the number of forced sellers. This biggest reason is due to the stress tests mortgage companies took out on borrowers since 2015, where they were ensuring people could afford 7% rates. People panicked, however they soon realised it was affordable. These regulations were designed to stop households taking on excessive debt at a time of low mortgage rates. They have stopped a major housing over-valuation and built resilience for many households to manage the transition to higher mortgage rates. While mortgage rates got as low as 1.3% in late 2021, all new mortgage borrowers had to prove to their bank they could afford a 6- 7% stressed mortgage rate to get the loan (below chart outlines stress testing data from bank of England). Banks were also limited to 15% of new business at high loan to income ratios over 4.5x.

What these regulations did was cap buying power for home buyers. They require home buyers to have a higher income to buy with larger deposits needed. First-time buyers in London put down an average deposit of £145,000 in 2022 compared to £26,000 for those buying in the North East. Today lenders are stress testing new borrowers at close to 9% despite mortgage rates starting to fall. This regulatory constraint on buying power is one reason we believe house prices are unlikely to rise in 2024, even as base rates start to fall later in the year.

First-time buyers to remain largest buyer group in 2024

Despite affordability issues facing first-time buyers, they are still the largest group of potential buyers. Zoopla’s latest survey found that 40% of people looking to buy a home in the next 2 years are first-time buyers. The main driving factor here is the rapid growth in rental prices, which is driving first-time buyers to want to buy, rents have risen faster than mortgages in all of the last three years even with larger deposits. A third of would-be buyers would be up-sizers, looking to buy a larger home, that will likely require larger mortgages. Buying is more realistic that renting on higher prices.

Buyers looking elsewhere for value

A quarter of home movers say they are looking to move more than 10 miles away (more than half of these are in southern region) from their current location to get better value for money. This is in the face of higher borrowing costs and people wanting for better value, this could be key in 2024 to how certain areas within the UK perform. This is particularly the case in high value housing markets where up-sizing is expensive. The proportion looking longer distances in other parts of the UK is lower. This is important for home builders and estate agents who tend to focus on demand and needs in local areas whereas there is the need to capture and nurture demand coming from further afield, especially as these buyers may well have more money to spend.

Isle of Wight Update

- Average house price end of 2023 was £365,179.

- Average house price today: £360,924.

Overview

There is likely to be a steady momentum in new sales agreed, following on from the last part of 2023, of which we have already seen for January 2024. Whilst mortgage rates are lowering, affordability is still difficult, meaning it is unlikely for us to see any growth throughout 2024, the more likely outcome would be a further 2% drop, to re-stabilise the market. It’s important to note each area of the UK will perform differently (below I have a graph of January 2024 performance across the UK). The modest decline in house prices over the year means UK housing still looks 10-15% overvalued at the end of 2023. Sales volumes are expected to hold steady at 1 million sales completions over 2024.